Let’s get this out of the way – the only essential terms for a real estate sale contract are the identities of the buyer and seller, the property in question, and the purchase price. Essentially, that is the law in California. Of course, the courts have found ways around the rule, but the trend of the law favors carrying out the parties’ intent once the court has determined that the parties had intended to make a contract. The courts will hear evidence of the parties’ intent to explain essential terms. (Okun v. Morton, 203 Cal. App. 3d 805) Sacramento real estate attorneys are occasionally asked about contracts in which all the standard details are left out, and asked how to enforce, or deny, the contract. When there is no time for payment specified, I always advise the “a reasonable time” is inferred, whatever that means in the circumstances. Such a situation was addressed by the Supreme Court when a tenant wanted to enforce a purchase option that was included in the lease.

In Patel v. Liebermensch, the tenants leased a condo in San Diego. The lease included the following purchase and sale option:

In Patel v. Liebermensch, the tenants leased a condo in San Diego. The lease included the following purchase and sale option:

“Through the end of the year 2003, the selling price is $290,000. The selling price increases by 3% through the end of the year 2004 and cancels with expiration of your occupancy. Should this option to buy be exercised, $1,200.00 shall be refunded to you.”

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

In

In  In

In  The judge was not impressed by Gavina’s conduct. Because of the nature of the suit (quiet title), it first addressed the question of whether the option itself created a contract, or was merely an executable contract to make a lease. It found the intent of the parties, as expressed in the option agreement, to set forth in both the option and the attached form of lease all the terms and conditions on which Gavina’s offer to lease was made. By exercising the option, Smith accepted the offer and agreed to the lease on the those terms. The requirement of a written lease was satisfied. (

The judge was not impressed by Gavina’s conduct. Because of the nature of the suit (quiet title), it first addressed the question of whether the option itself created a contract, or was merely an executable contract to make a lease. It found the intent of the parties, as expressed in the option agreement, to set forth in both the option and the attached form of lease all the terms and conditions on which Gavina’s offer to lease was made. By exercising the option, Smith accepted the offer and agreed to the lease on the those terms. The requirement of a written lease was satisfied. ( In

In  In

In  However, there is a limit to how long the court may keep jurisdiction over the parties. In

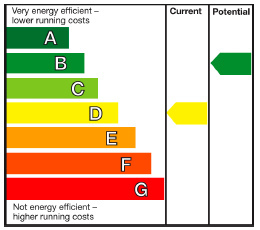

However, there is a limit to how long the court may keep jurisdiction over the parties. In  ENERGY USE REPORTING

ENERGY USE REPORTING In

In