I’ve written before about California adverse possession and prescriptive easements. These are two legal concepts in which a party who does not own a property to establish an interest in it, and possibly own clear title. The concept is that the true owner must monitor their property; in California they ave five years to correct any issues with use. The elements of adverse possession are:

(1) possession under claim of right (claiming a right to use the property, though not founded on a written instrument; the claim need not be based on a good faith belief in the title), or color of title (a written or deeded easement, though it may be incorrect or in the wrong location) ;

(2) The claimant must occupy or utilize the land in a way (actual, open, and notorious) that constituting reasonable notice to the true owner;

(3) possession which is adverse and hostile to the true owner;

(4) continuous possession for at least five years; and

(5) payment of all taxes assessed against the property during the five-year period.

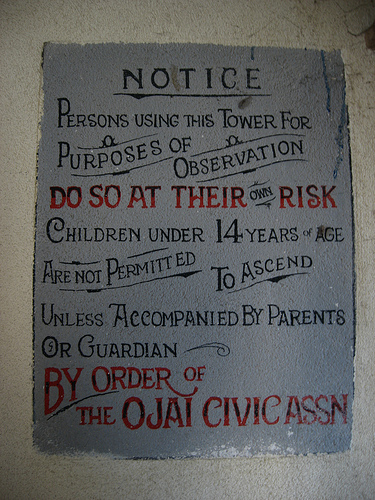

Prescriptive easements require the same elements, except taxes do not need to be paid. Sacramento and Yolo real estate attorneys often see prescriptive easement claims, but not as often may adverse possession be alleged because of the tax issue. In a recent decision concerning land in Ojai, the owner was a religious organization that obtained an exemption from paying local property taxes. Since there were no taxes assessed, the lucky adverse possessor got tile to nearly a half acre without paying the tax.

In Maj I. Hagman, trustee, v. Meher Mount Corporation, a 30 acre parcel in Ojai was owned by Meher Mount, which qualified for a tax exemption as a religious corporation using its property for education purposes. One of the fences was in the wrong place, and for 24 years Hagman had been occupying and improving nearly a half acre of Meher Mount property. Hagman sued for quiet title to establish his ownership of the disputed half acre. Meher Mount had two arguments; first, that tax exempt religious organizations are public entitles immune from adverse possession under Civil Code section 1007, and secondly, that Hagman did not prove that he had paid the yearly property taxes as per Civil Code section 325.

In Maj I. Hagman, trustee, v. Meher Mount Corporation, a 30 acre parcel in Ojai was owned by Meher Mount, which qualified for a tax exemption as a religious corporation using its property for education purposes. One of the fences was in the wrong place, and for 24 years Hagman had been occupying and improving nearly a half acre of Meher Mount property. Hagman sued for quiet title to establish his ownership of the disputed half acre. Meher Mount had two arguments; first, that tax exempt religious organizations are public entitles immune from adverse possession under Civil Code section 1007, and secondly, that Hagman did not prove that he had paid the yearly property taxes as per Civil Code section 325.

Public Entity

The court found that public benefit corporations are not public corporations, nor are they public entities. Public entities have some degree of sovereignly, public benefit corporations have none. They cannot tax or condemn, nor serve a government purpose.

Adverse Possession

Code of Civil Procedure section 325 requires that the adverse possessor prove that they “have timely paid all state, county, or municipal taxes that have been levied and assessed upon the land for the period of five years…Payment of those taxes by the party or persons, their predecessors and grantors shall be established by certified records of the county tax collector.” A tax is assessed when the county assessor places the property on the roll, listing its valuation and tax. A tax is levied when the county board of supervisors fixes the tax rate and orders that taxes be paid. However, here the county granted Meher Mount an exception, which assures that the property is not placed on the assessor’s roll.

Meher Mount argued that establishing this rule will make it easier to adversely possess tax exempt corporations, and that the tax exemption is meant to benefit the public-minded property owner but here excuses the adverse possessor from paying the statutory duty to pay taxes. The court said that may be, but it was not free to chose when faced with statutes that controlled the decision.

Meher Mount argued that establishing this rule will make it easier to adversely possess tax exempt corporations, and that the tax exemption is meant to benefit the public-minded property owner but here excuses the adverse possessor from paying the statutory duty to pay taxes. The court said that may be, but it was not free to chose when faced with statutes that controlled the decision.

This decision makes sense, because the court closely followed the statute as it was required to do. However, it should ring a bell for all tax-exempted land owners, because now it is a little bit easier to adversely possess their property, and sophisticated neighbors will figure this out. The tax exempt land owner must be more vigilant about its real estate now.

Photos: http://tinyurl.com/lxmaqfa

http://www.flickr.com/photos/kenlund/4052043522/sizes/m/in/photostream/

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog