A common belief is that to claim adverse possession of real property, all one has to do is pay five years of overdue property tax, and take possession of the property. Parties trying to establish adverse possession in California must prove several elements: (1) Possession must be by actual occupation under such circumstances as to constitute reasonable notice to the owner. (2) It must be hostile to the owner’s title. (3) The holder must claim the property as his own under either color of title or claim of right. (4) Possession must be continuous and uninterrupted for five years. (5) The holder must pay all the taxes levied and assessed upon the property during the period. This last element is seldom the focus of court decisions, but in a recent decision the claimant was disappointed to learn that a change in the law requires timely payment of assessed property taxes.

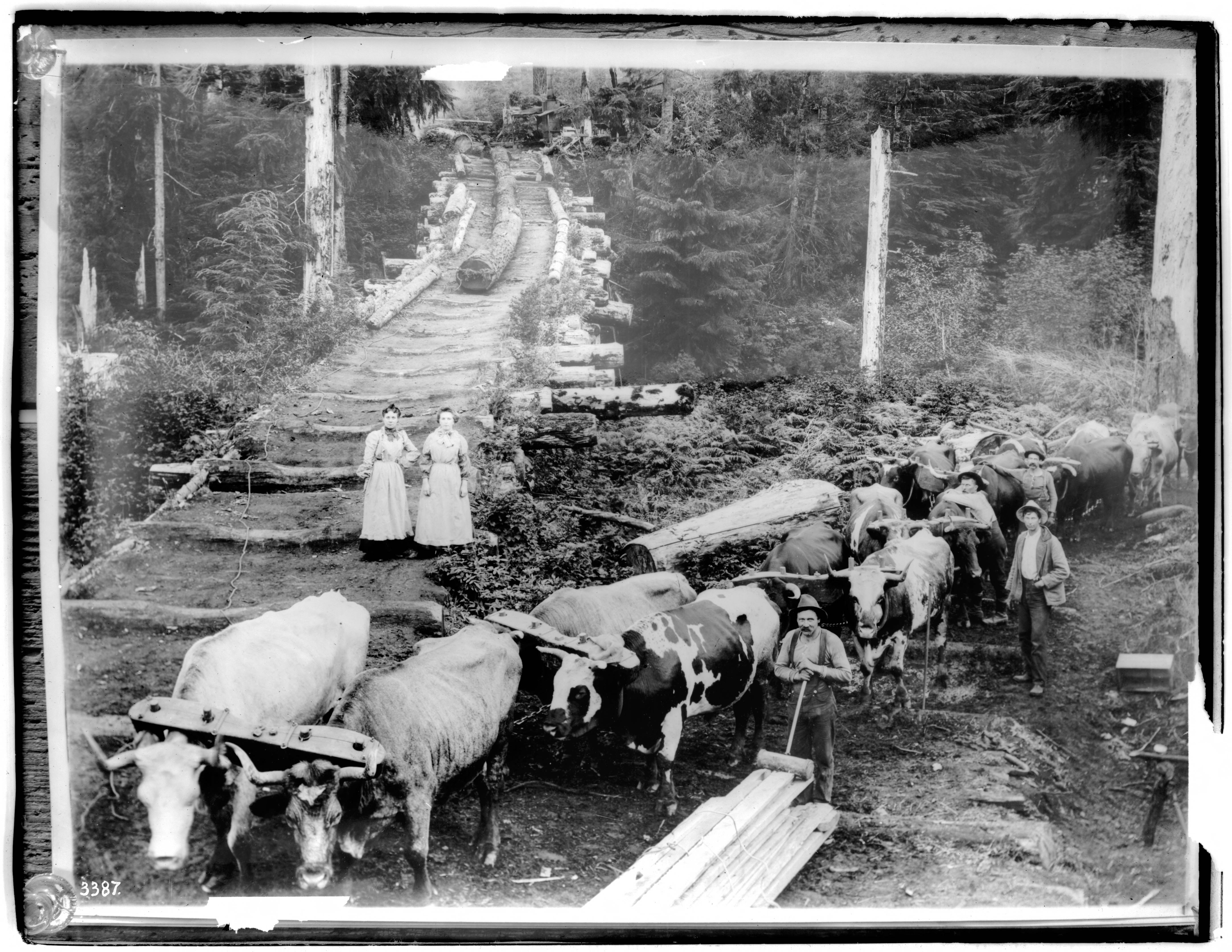

In McLear-Gary v. Emrys Scott, McLear-Gary claimed an easement along a logging skid trail. Emrys Scott replaced an old wooden gate with a metal gate across the easement route and kept the gate locked, blocking McLear-Gary from accessing the easement.

In McLear-Gary v. Emrys Scott, McLear-Gary claimed an easement along a logging skid trail. Emrys Scott replaced an old wooden gate with a metal gate across the easement route and kept the gate locked, blocking McLear-Gary from accessing the easement.

The trial court found that McLear-Gary had established an “exclusively pedestrian” prescriptive and implied easement over the properties belonging to the defendants, the court concluded this easement was extinguished by adverse possession when Emrys Scott, acting for the benefit of the common interests of his cotenants, locked and maintained the locked gate (not always hostile notice of adverse possession!) across the easement route and otherwise met the requirements for the affirmative defense.

On appeal McLear-Gary argued that the defendants were required to prove timely payment of each annual installment of during the statutory period in order to extinguish her easement by adverse possession, and thus, the Scotts’ lump sum payment of delinquent taxes did not constitute a timely payment. The defendants countered that they were not required to prove payment of any taxes because McLear-Gary’s easement was not separately assessed.

Section 325, subdivision (b) states, in pertinent part: “In no case shall adverse possession be considered established under the provision of any section of this code, unless it shall be shown that … the party or persons, their predecessors and grantors, have timely paid all state, county, or municipal taxes that have been levied and assessed upon the land for the period of five years during which the land has been occupied and claimed. Payment of those taxes by the party or persons, their predecessors and grantors shall be established by certified records of the county tax collector.” (Italics added.)

Section 325, subdivision (b) states, in pertinent part: “In no case shall adverse possession be considered established under the provision of any section of this code, unless it shall be shown that … the party or persons, their predecessors and grantors, have timely paid all state, county, or municipal taxes that have been levied and assessed upon the land for the period of five years during which the land has been occupied and claimed. Payment of those taxes by the party or persons, their predecessors and grantors shall be established by certified records of the county tax collector.” (Italics added.)

Separate Assessment of the Easement

The court first noted that there is a presumption that no taxes are levied against an easement, so proof of payment of taxes on the easement is not required for adverse possession; only payment of taxes for the fee title. The Court quoted Miller and Starr: “The owner of a servient tenement who has paid the taxes on the entire property does not have to prove payment of any taxes on the easement unless the easement owner establishes that it was separately assessed.”

The court next considered what the legislature meant by “timely payment,” and reviewed the legislative history for the 2010 amendment. The legislature was concerned with the tax payment scam – “a problem in which would-be adverse possessors scan tax records for parcels of land with outstanding tax obligations, make a lump-sum payment of taxes for the previous five years, and then claim that they have occupied the land for that five-year period. … This bill addresses the problem of persons who attempt to make post hoc payments on land with outstanding tax obligations.” Further, that the new bill required that it be established by certified records of the county tax collector and show that the taxes were paid continuously throughout the five year statutory period.” (Italics added.) A single lump sum payment of delinquent taxes for previous years—even if made during a five-year period of occupancy- cannot be construed as showing “continuous” payments “throughout” the statutory period.

The court concluded that the rule is that the adverse possessor must establish, by certified records of the tax collector, that they made timely payments continuously each year throughout the statutory period.

PHOTOS:

flickr.com/photos/wikimediacommons/16042224733/in/photostream/

flickr.com/photos/jr-transport/22901212883/sizes/l

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog