Quiet title is a lawsuit used in California to establish title to real estate against adverse claims. Quiet title attorneys know that If there is a dispute as to title, and claims against a property, the court order decides it once and for all- or almost all. California statutes allow naming even unknown defendants, and publishing notice of the suit. However, on homeowner who was victim of a scam found out the her quiet title judgment did not affect a deed of trust.

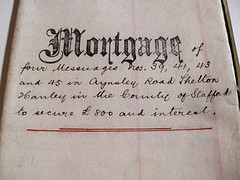

In Deutsche Bank v McGurk, McGurk owned a home until she was convinced by scamsters to convey the property to them, and take back a lease- option. The scamsters then got a new loan against the property from lender New Century, and took off with the cash. She filed a quiet title action against the scamsters and New Century, and recorded a lis pendens. New Century filed Bankruptcy. It then assigned the subject deed of trust to Deutsche Bank, which neither recorded the assignment nor notified McGurk. McGurk dismissed New Century from the quiet title to chase them in bankruptcy court, and proceeded against the others in the quiet title lawsuit.

In Deutsche Bank v McGurk, McGurk owned a home until she was convinced by scamsters to convey the property to them, and take back a lease- option. The scamsters then got a new loan against the property from lender New Century, and took off with the cash. She filed a quiet title action against the scamsters and New Century, and recorded a lis pendens. New Century filed Bankruptcy. It then assigned the subject deed of trust to Deutsche Bank, which neither recorded the assignment nor notified McGurk. McGurk dismissed New Century from the quiet title to chase them in bankruptcy court, and proceeded against the others in the quiet title lawsuit.

The Quiet Title Judgment

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

2923.5

2923.5 To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be

To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be  In a recent case the lender tried to claim that, because a tenant abandoned the premises, the bad boy was triggered and the guarantor was liable.

In a recent case the lender tried to claim that, because a tenant abandoned the premises, the bad boy was triggered and the guarantor was liable.  Complaints can be made by phone, mail, fax, or

Complaints can be made by phone, mail, fax, or  Some considerations:

Some considerations: The buyer may direct the borrower to a third-party lender to refinance (at a discount to the remaining balance, though with a premium). If these steps fail, they may just foreclose or accept a deed in lieu of foreclosure. In the case of La Rivage, mentioned above, the lender filed a lawsuit for judicial foreclosure, had a receiver appointed, but is still trying to work out the loan.

The buyer may direct the borrower to a third-party lender to refinance (at a discount to the remaining balance, though with a premium). If these steps fail, they may just foreclose or accept a deed in lieu of foreclosure. In the case of La Rivage, mentioned above, the lender filed a lawsuit for judicial foreclosure, had a receiver appointed, but is still trying to work out the loan.