When a foreclosure sale occurs, the lender often bids at the sale the entire amount due on the loan. If no one bids higher, they obtain the property. But are they entitled to then collect insurance for pre-foreclosure damage? Sometimes insurers obtain their own insurance policy, which covers them for all damage to the property. However, commercial lenders often are insured through their borrower’s policy, which only covers the value of the debt. There is an important difference if the lender forecloses, and parities in this situation may need to consult with a real estate attorney. In a recent case, the lender discovered that making a full credit bid at the foreclosure sale was a mistake, and lost its chance to collect on the policy.

In Najah v. Scottsdale Insurance Company, the plaintiff sold a commercial property taking back a note for $2.5 million secured by a 2nd deed of trust. The first loan was for $2 million. There was a structure on the property, and the terms of the Notes required that the buyer not remove or destroy the building, and to repair any damage that occurred. The Note required the buyer to provide an all risk insurance policy insuring the seller, which the buyer obtained.

In Najah v. Scottsdale Insurance Company, the plaintiff sold a commercial property taking back a note for $2.5 million secured by a 2nd deed of trust. The first loan was for $2 million. There was a structure on the property, and the terms of the Notes required that the buyer not remove or destroy the building, and to repair any damage that occurred. The Note required the buyer to provide an all risk insurance policy insuring the seller, which the buyer obtained.

The Buyer went into default and the first lender pursued foreclosure. The seller, holder of the second, bought the interest of the first lender for the balance due on the first loan, $1.75 million. The Seller was also assigned the first deed of trust. The seller then foreclosed on its 2nd deed of trust. At the foreclosure sale, the Seller made a full credit bid – that is, it bid the full amount due on the 2nd Note.

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

In

In  A dilemma arises when the property owner pays off the loan, but has not yet completed full performance of other obligations secured by the deed of trust. Usually, on paying off the loan, the borrower wants the lender to record a reconveyance of the deed of trust, effectively removing the ‘lien’ from the record. However, courts have found that reconveyance was not required. Such was the case in

A dilemma arises when the property owner pays off the loan, but has not yet completed full performance of other obligations secured by the deed of trust. Usually, on paying off the loan, the borrower wants the lender to record a reconveyance of the deed of trust, effectively removing the ‘lien’ from the record. However, courts have found that reconveyance was not required. Such was the case in  The beneficiary can extend the time by recording a “notice of intent to preserve interests” prior to the expiration of the prescribed time period. If this notice is timely recorded, the period is extended until 10 years after the notice is recorded. Civil Code section 880.310(a), 880.020(a)(3). If one has a concern about the limitations of their deed of trust, they should consult a

The beneficiary can extend the time by recording a “notice of intent to preserve interests” prior to the expiration of the prescribed time period. If this notice is timely recorded, the period is extended until 10 years after the notice is recorded. Civil Code section 880.310(a), 880.020(a)(3). If one has a concern about the limitations of their deed of trust, they should consult a  Civil Code section 2787 provides that a “guarantor is one who promises to answer for the debt, default, or miscarriage of another…” What has become known as a sham guaranty is one where the guarantor is found to be the same as the borrower. The clearest case is where an individual signs a promissory note promising to pay the debt. The lender requires the same individual to sign a guaranty for the same debt, waiving many defenses. For example, there are statutory anti-deficiency protections for real estate borrowers, prohibiting the lender from collecting from the borrower. These protections are not extended to guarantors, and loan guaranties usually have waivers of all these defenses. In the sham guaranty the lender may think that by having the same borrower guaranty the loan allows for a deficiency judgment against the borrower as guarantor. Or, it may be used in hopes that the borrower/guarantor does not understand, and truly expects to be personally liable for the debt.

Civil Code section 2787 provides that a “guarantor is one who promises to answer for the debt, default, or miscarriage of another…” What has become known as a sham guaranty is one where the guarantor is found to be the same as the borrower. The clearest case is where an individual signs a promissory note promising to pay the debt. The lender requires the same individual to sign a guaranty for the same debt, waiving many defenses. For example, there are statutory anti-deficiency protections for real estate borrowers, prohibiting the lender from collecting from the borrower. These protections are not extended to guarantors, and loan guaranties usually have waivers of all these defenses. In the sham guaranty the lender may think that by having the same borrower guaranty the loan allows for a deficiency judgment against the borrower as guarantor. Or, it may be used in hopes that the borrower/guarantor does not understand, and truly expects to be personally liable for the debt. In

In  Some Contract defaults that may trigger acceleration

Some Contract defaults that may trigger acceleration In

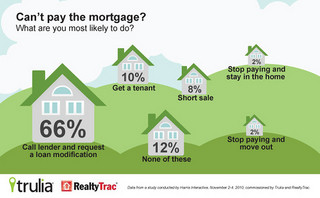

In  In Corvello v. Wells Fargo Bank, the court framed the issue: whether the bank was contractually required to offer the plaintiff a permanent loan modification after they complied with the requirements of a trial period plan (“TPP”). The answer was yes. The court first reviewed the federal programs resulting from TARP to assist homeowners. It noted that Wells Fargo, and others, signed “Servicer Participation Agreements” with the U.S. Treasury. It entitled the lenders to incentive payments for loan modifications, and requires them to follow Treasury guidelines.

In Corvello v. Wells Fargo Bank, the court framed the issue: whether the bank was contractually required to offer the plaintiff a permanent loan modification after they complied with the requirements of a trial period plan (“TPP”). The answer was yes. The court first reviewed the federal programs resulting from TARP to assist homeowners. It noted that Wells Fargo, and others, signed “Servicer Participation Agreements” with the U.S. Treasury. It entitled the lenders to incentive payments for loan modifications, and requires them to follow Treasury guidelines.