Property buyers in California purchase a title insurance policy as a matter of course. Many do not understand what exactly such insurance does for them, and should consult with an experienced Sacramento real estate attorney. Title insurance does not guaranty the state of title. Instead, it is an agreement to indemnify the buyer / insured for losses incurred as a result of defects in, or encumbrances on, title. One buyer bought seven adjacent parcels in Santa Clara County, with a plan to sell parcel number 7. When the buyer backed out because of the title situation, he sued the title company, but lost.

In Deanza Assoc. v. Chicago Title Insurance, the problem was that the city had recorded a “Notice of Merger” of the seven parcels prior the purchase by the plaintiff. Deanza then went into contract to sell number 7, but the buyer backed out when they discovered the notice of merger.

In Deanza Assoc. v. Chicago Title Insurance, the problem was that the city had recorded a “Notice of Merger” of the seven parcels prior the purchase by the plaintiff. Deanza then went into contract to sell number 7, but the buyer backed out when they discovered the notice of merger.

Deanza filed a claim against their title insurance policy. Chicago Title first denied, claiming that the CLTA policy excluded claims regarding governmental regulation whether or not shown in public records. The title company said oops, you paid for an ALTA policy, we issued a CLTA, so your claim is covered. Then they said oops, the claim is not covered. The Notice of Merger impacts only the value and use of the property, not the validity of your title. Deanza filed suit.

California Real Estate Lawyers Blog

California Real Estate Lawyers Blog

In

In  Two pedestrians were stuck by a car while crossing the street in Los Altos. They suffered serious injuries, and in a lawsuit named the city claiming this was a dangerous intersection. The city cross-sued the homeowner, charging that a large tree was a hazard and blocked visibility. The tree was not on the homeowner’s property, but adjacent to it. The owner never trimmed the trees, but PG&E did because there were power lines running through it- PG&E told the owner not to touch it. Now the owner needs to be worried about

Two pedestrians were stuck by a car while crossing the street in Los Altos. They suffered serious injuries, and in a lawsuit named the city claiming this was a dangerous intersection. The city cross-sued the homeowner, charging that a large tree was a hazard and blocked visibility. The tree was not on the homeowner’s property, but adjacent to it. The owner never trimmed the trees, but PG&E did because there were power lines running through it- PG&E told the owner not to touch it. Now the owner needs to be worried about  In

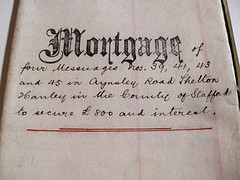

In  In historical terms, the California deed of trust is a recent development. Originally parties used a “mortgage” in which the property was conveyed by the buyer to the lender, subject to payment of the debt. Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit. The property was conveyed to the buyer, who kept the right to possession, but he then conveys “nominal title” to the trustee, who, on instruction from the lender, could hold a foreclosure (by trustee’s sale) without court involvement. Borrowers and lenders concerned with the difference should contact an

In historical terms, the California deed of trust is a recent development. Originally parties used a “mortgage” in which the property was conveyed by the buyer to the lender, subject to payment of the debt. Prior to payment of the debt, the lender was entitled to possession of the property. Use of the deed of trust with power of sale was developed to get around some of the restrictions of the mortgage and the required judicial foreclosure, a time consuming lawsuit. The property was conveyed to the buyer, who kept the right to possession, but he then conveys “nominal title” to the trustee, who, on instruction from the lender, could hold a foreclosure (by trustee’s sale) without court involvement. Borrowers and lenders concerned with the difference should contact an  2923.5

2923.5 To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be

To get to the tender issue, we must first look at unconscionability. The first step taken by the court was to see if this was a “contract of adhesion.” This one was- it was a standardized contract drafted by the party with superior bargaining power without negotiation, giving the plaintiff only the choice between adhering to the contract or rejecting it. The court said yes, it could be contract of adhesion. The next step was to decide whether there were any other factors that made it unenforceable, such as if was unduly oppressive or unconscionable. Here, the plaintiff’s allegations show that it was, in two ways. First, based on the interest rates and balloon payment, and second, it was unconscionable due to his inability to replay the debt. Thus, the contract could be  In seeking the injunction, the borrowers swore in declarations that at no time prior to the notice of default did the lender contact the borrower to explore options as required by

In seeking the injunction, the borrowers swore in declarations that at no time prior to the notice of default did the lender contact the borrower to explore options as required by  Connolly bought three adjacent lots in Garberville. On the northern boundary of Lot 17 they fenced off a portion so that it was part of their adjacent lot to the North. In other words, they were using a portion of the Northen end of Lot 17. They made a deal with Dobbs to sell him lot 17, with the oral agreement that Connally would keep title to the fenced off portion of 17, and there would be a “lot line adjustment” to accomplish that.

Connolly bought three adjacent lots in Garberville. On the northern boundary of Lot 17 they fenced off a portion so that it was part of their adjacent lot to the North. In other words, they were using a portion of the Northen end of Lot 17. They made a deal with Dobbs to sell him lot 17, with the oral agreement that Connally would keep title to the fenced off portion of 17, and there would be a “lot line adjustment” to accomplish that.