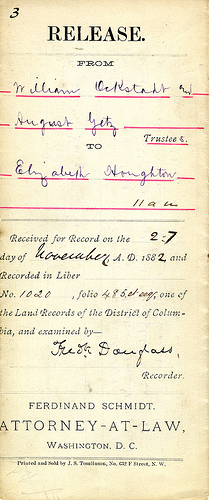

A California slander of title suit is a claim that someone published a false statement about real estate which harms the properties value or salability. One of the requirements of the claim is that there be a direct pecuniary loss.

In Sumner Hill v. Rio Mesa, A subdivision was built on bluffs overlooking the San Joaquin River in Madeira County. Owners in the subdivision has unrestricted private access to the river across other property using Killkelly Road. Killkelly Road was shown on the amended Subdivision Map as a dedicated public road. Property owners who believe the are victims of a slander of title should consult an experienced Sacramento and Yolo real estate attorney to see what their options are. In a recent decision, a defendant (the slanderer) was surprised that the plaintiff had no pecuniary loss other than the attorney fee involved in the lawsuit, and that was enough to make their case.

In Sumner Hill v. Rio Mesa, A subdivision was built on bluffs overlooking the San Joaquin River in Madeira County. Owners in the subdivision has unrestricted private access to the river across other property using Killkelly Road. Killkelly Road was shown on the amended Subdivision Map as a dedicated public road. Property owners who believe the are victims of a slander of title should consult an experienced Sacramento and Yolo real estate attorney to see what their options are. In a recent decision, a defendant (the slanderer) was surprised that the plaintiff had no pecuniary loss other than the attorney fee involved in the lawsuit, and that was enough to make their case.

The other property, which Killkelly Road crossed, was sold, and the new owner planned a new subdivision. They were unaware of the neighbor’s right to use the road. One day the new owner saw someone in a truck on the road, who told him that all the owners in the subdivision had the right to use it. Panic ensued.

n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

n La Jolla Group II v. Bruce (5th Dist. F061829; 211 CalApp 4th 461), the Baquiran’s owned their home for 16 years. In 2003 a notice of default & note of trustee’s sale were recorded for default on a second deed of trust secured by the residence. However, the Baquirans had no knowledge of a second deed of trust. The foreclosure sale occurred, and La Jolla Group bought the property at the trustee’s sale.

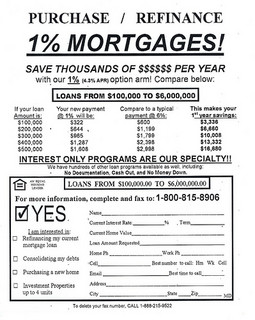

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to

With rates at an all time low, many in California are rushing to refinance their real property mortgage loans. Often, borrowers are not aware that they may expose themselves to  The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale.

The change makes sense in light of the historic purpose of Civil Procedure section 580b. In the event of a depression of land values, it is to prevent aggravating the downturn that would result if defaulting purchasers lost the land plus had personal liability. It is based on the premise that the lender is in the best position to determine the true value of the security for its loan, which is the property. If the lender overvalues the property, the lender should bear the risk of not obtaining the balance of the loan value in a foreclosure sale. The Mortgage Debt Forgiveness Act requires that the debt was incurred to buy or substantially improve the taxpayer’s principal residence. This includes a refinance loan, to the extent that the principal balance of the old mortgage would have qualified. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately). The amount of debt forgiven must be reported on your tax return. The act first extended such relief for three years, applying to debts discharged in calendar year 2007 through 2009; with the Emergency Economic Stabilization Act of 2008, this tax relief was extended another three years, covering debts discharged through calendar year 2012.

The Mortgage Debt Forgiveness Act requires that the debt was incurred to buy or substantially improve the taxpayer’s principal residence. This includes a refinance loan, to the extent that the principal balance of the old mortgage would have qualified. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately). The amount of debt forgiven must be reported on your tax return. The act first extended such relief for three years, applying to debts discharged in calendar year 2007 through 2009; with the Emergency Economic Stabilization Act of 2008, this tax relief was extended another three years, covering debts discharged through calendar year 2012. The forgiven debt may also be excluded from your income if:

The forgiven debt may also be excluded from your income if: In

In  In

In  In

In